The TurboTax Freedom Edition is another name TurboTax uses for its Free File edition. This edition is required as part of the industry’s deal with the IRS. If you make less than $34,000 per year. TurboTax will calculate how much you owe to the different states where you have earned income. State income tax tip A good way to do your own research on each state's tax filing requirements is through the state tax authority's website. All the state tax websites are listed for you at State Income Tax Forms. The extra unwanted state files appear to be in the Windows folder C: Program Files (x86) TurboTax Deluxe 201x Forms but deleting them doesn't kill the download/updater process. Eventually they turn up again when the updater re-downloads them. Must be a hidden switch somewhere or hard coded in the software.

We’ll help you file both your state and federal

taxes for free, if you qualify.

Read on to learn if you qualify for the IRS

Free File Program.

If you can answer 'yes' to any of these questions,

you qualify

Is your adjusted gross income (AGI) $39,000 or less?

Were you active duty military in 2020 with an AGI of $72,000 or less?

Do you qualify for the Earned Income Tax

Credit (EIC)?

I don’t qualify. Now what?

If you answered no to all of these items, you may still

qualify for other IRS Free File offers.

qualify for other IRS Free File offers.

All states are completely free with IRS Free File Program

delivered

by TurboTax.

If you qualify for free federal filing, you also qualify for free state filing. Learn more.

Get a fast tax refund

9 out of 10 taxpayers who e-file typically receive their refund

within

21 days.Most tax forms supported

IRS Free File Program powered by TurboTax supports most federal forms and state forms.

Spend some.

Save some.Your refund check is the perfect opportunity to set aside the money you’ve been meaning

to save.Simple questions

about your lifeYou don’t need any tax knowledge to get your

taxes done right because TurboTax translates taxes

into simple questions about your life, like “do you

own a home,” and puts the information in the

right place for you.File with 100% confidence

We guarantee our calculations

are

100% accurate.W-2 import

Get a head start on your tax return by importing

your W-2 directly from over a million employers.Prior Year Tax

Return AccessGet access to your prior year tax return if you

previously filed with

the IRS Free File Program

delivered

by TurboTax.

IRS Free File Program delivered

by TurboTax

Intuit and the Intuit Financial Freedom Foundation are proud to donate tax preparation services to the IRS Free File Program. By using the IRS Free File Program delivered by TurboTax, low to moderate income tax filers have the ability to prepare and electronically file IRS and all state tax returns for free, while claiming all the deductions and credits

they deserve.

Your security.

Built into everything we do.See minimum system requirements

IRS Free File Program delivered by TurboTax was formerly known as TurboTax Free File Program

and TurboTax Freedom Edition.

How mush does TurboTax really cost? If you are considering using TurboTax to do your taxes this year, you should know what it’s going to cost.

First, even though they say it’s free, only people with simple taxes (such as 1040EZ) can file without paying. In fact, in addition to the cost of the software, you also have to pay a State filing fee.

Here’s all about the real cost of TurboTax:

TurboTax Cost: Online | LIVE | CD/Download | State Cost | Refund Processing Fee?

TurboTax ONLINE Cost:

The most popular way to file your taxes with TurboTax is online. This method does not require downloading software, and your info is all securely saved on the cloud. As you can see, the regular price comes down when you use a coupon.

Here is the cost of TurboTax Online:

- Deluxe: $59.99*

- Premier: $79.99*

- Self-Employed: $119.99*

There is also special TurboTax pricing available for students and members of the military / USAA, and your financial institution may also offer a discount.

*While there is n additional cost to prepare your state return, you must also pay a State filing fee for each state that you file in.

*Tip: As you can see, using a coupon code lower the price of TurboTax Online products! The best coupons are available early in the tax season.

TurboTax LIVE Cost:

If you would like assistance from a real, human CPA during the tax-filing process, then consider TurboTax Live. However, that personal assistance isn’t free, so the prices are higher than Online-only.

Here is the cost of TurboTax Live:

- Basic Live: $79.99*

- Deluxe Live: $119.99*

- Premier Live: $169.99*

- Self-Employed Live: $199.99*

*You’ll also need to add the State filing fee for each tax return. (See the cost of State file below)

*Tip: As you can see, using a coupon reduces the cost of TurboTax Live products!

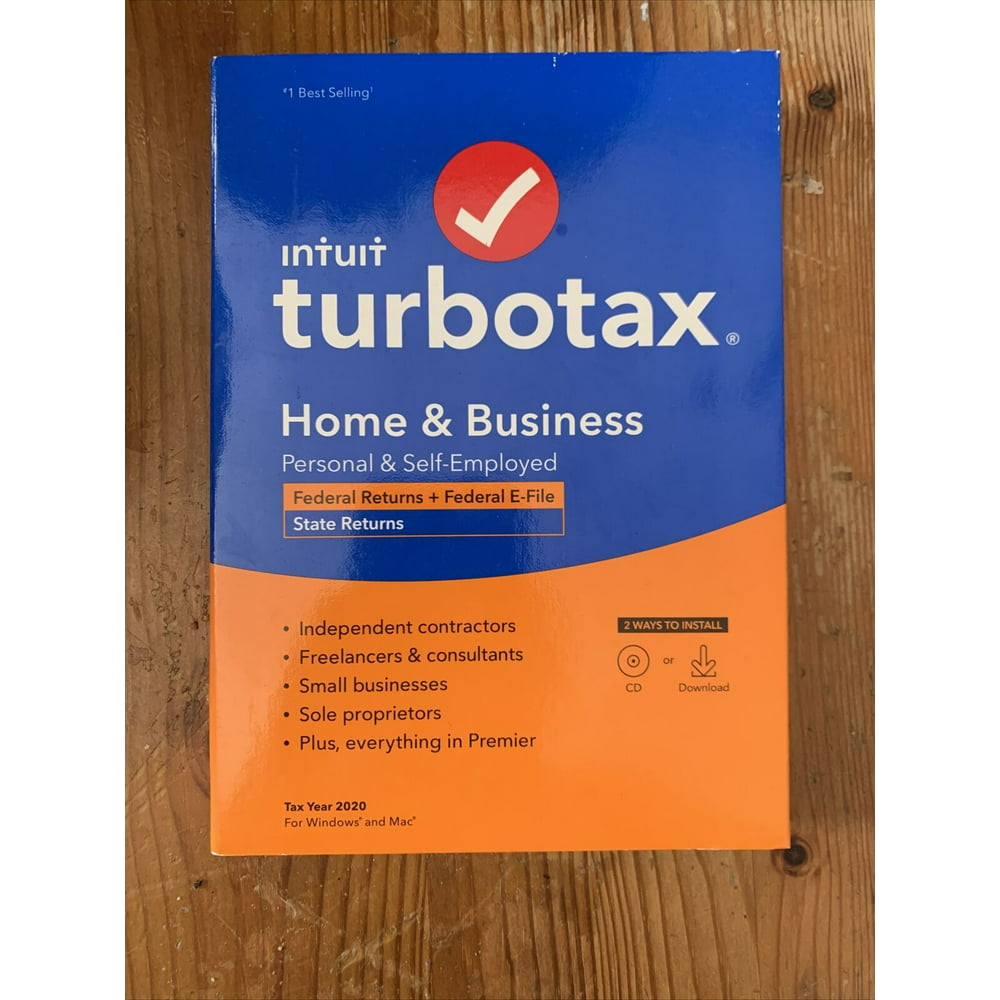

TurboTax CD/Download Cost:

While TurboTax encourages you to do your taxes with their online products, CD and download are still available. If you don’t have dependable internet access, then download or buying at a store like Costco may be a good option.

Here is the regular price of TurboTax software download:

- Basic: $49.99

- Deluxe: $79.99

- Premier: $109.99

- Home & Business: $119.99

- Business: $169.99

As you can see, the cost of downloading turbotax software is more than the Online versions. However, if you are a member of discount clubs like Costco, you can get a better price on buying TurboTax in the box.

While we’ve covered the pricing for filing your Federal taxes with TurboTax, you’ll also want to account for your State e-file fee. Here is what filing your TurboTax State return costs:

State Cost / Filing Fee:

How much does TurboTax State cost? While there is no extra charge to prepare your state tax return with TurboTax, you will have to pay a state filing fee for each tax return that you e-file.

Here is the cost of filing each State return:

- State Fee if you use Deluxe, Premier, or Self Employed: $39.99

- State Fee if you use TurboTax Free Edition: $29.99

The state filing fee is the same for every state. Remember, if you have income from multiple states, you’ll need to pay a state fee for each state return that you file.

Can you avoid the state filing fee? While there are no coupons for TurboTax Sate file, you can avoid paying the State file fee if you file before March 15th!

*Related: New H&R Block costs

Tip: Don’t Pay the “Refund Processing Fee!”

Ok, here’s a big fee that you can avoid, so listen closely. Upon completion of their taxes, a lot of taxpayers are dazed and confused after hours of sifting through papers and crunching numbers.

Turbotax Entitlement File State 2019

Maybe that’s why Turbo Tax chooses this moment to ask you if you’d like to pay your TurboTax fees from your federal refund:

It sounds like a good idea, and very convenient to pay without having to enter a credit card, right?

No! It will cost you an unnecessary $39.99, and seems to have no value other than to save you the minute of time it would take to just enter your credit card info!

Conclusion:

While the cost of TurboTax doesn’t change throughout the tax season, the promotions and coupons do. You’ll save more early in the tax season when you can also file State returns for free; so don’t procrastinate!

Not sold on TurboTax? We also have coupons for H&R Block and TaxAct, which may allow you to file your taxes at a lower cost.

File State Taxes Free

Do you think that TurboTax is too expensive? Here’s what people pay to file their own taxes.